Steel prices touch all time high levels

| Date :06-May-2021 |

Business Bureau :

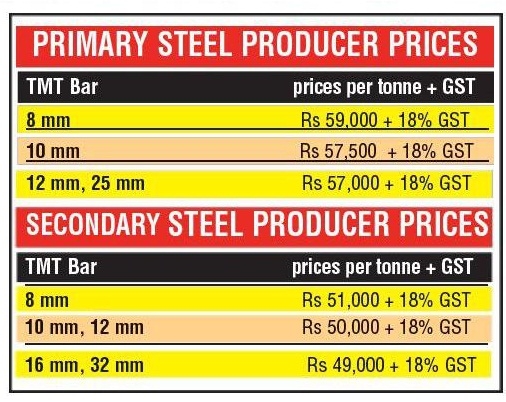

As the conditions in international markets are pushing up steel prices consistently for the past few months, recently the commodity has touched its all time high here in the local market. The steel TMT bar prices by primary producers like Tata Steel, Jindal Steel and Sail touched the Rs 59,000 per tonne (excluding 18% GST) mark which is about 10 per cent higher than the level prevailing in the month of February 2021. The primary producers prices of 8 mm steel bars, are being quoted at Rs 59,000 per tonne. Similarly, the cost of 10 mm bars is at Rs 57,500 per tonne (excluding 18 per cent GST) and 12 mm to 25 mm bars to Rs 57,000 per tonne.

The price difference of primary and secondary steel producers is the quality and manufacturing process involved in making steel products. The primary steel producers use blast furnace whereas the secondary producers use induction furnace process to make steel products. Currently, the secondary producers prices of 8 mm steel bars is being quoted at Rs 51,000 per tonne (excluding GST), 10 mm steel bars at Rs 50,000 per tonne and 12 mm to 25 mm at Rs 49,000 per tonne. Senior Vice-President of Steel and Hardware Chamber of Vidarbha Rajesh Sarda told The Hitavada that the price rise is because of severe shortage of the iron ore in the international market. “As of now, there is a huge demand for the steel products because China is aggressively buying the commodity.

On the other hand, countries like Brazil, which supply iron ore, are not supplying enough quantities of the commodity. These conditions are driving up the prices for the past few months,” he said. Sarda also said that the prices may further rise in near future as there are no signs of improvement in the raw material supply. It is important to note that China is buying steel and iron ore in huge quantities from the international markets. Thus, many domestic suppliers have been engaged in exporting the commodities which is further creating a shortage of raw material in the country. Past President of CREDAI Nagpur Chapter Prashant Sarode said that the current prices have caused a negative impact on the real estate sector.

“The sector was already bearing the brunt of lockdown and now the steep rise in prices of steel and cement are making the housing projects unfeasible. It is going to affect affordable housing projects as well other infrastructure projects in a big way,” he said. Past President of CREDAI Nagpur Chapter Anil Nair said that the steel and cement price rise will increase cost of construction by about Rs 200 to Rs 250 per square feet. “This will put additional burden on the buyers. CREDAI has been taking up the steel price issue with the Central Government but everything has been brushed under the carpet.” “The steel producers are raising the steel prices irrationally and indulging in cartelisation. Government should do something and lower the steel prices in the country,” he added.