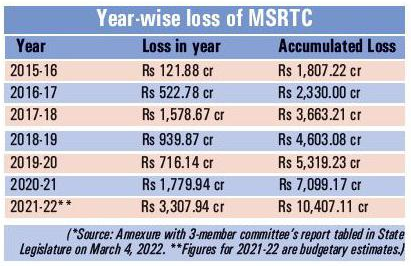

MSRTC’s accumulated loss projected to increase to Rs 10,407 crore

| Date :05-Mar-2022 |

Though the Maha Vikas Aghadi (MVA) Government in Maharashtra has stated clearly that it is not possible to merge Maharashtra State Road Transport Corporation (MSRTC) with State Government, there is more to the story. As per the annexure with the report of the three-member committee, tabled in State Legislature on Friday, the accumulated loss of MSRTC is projected to rise to Rs 10,407.11 crore at the end of current financial year 2021-22. Against this backdrop, the State Government has drawn up a revival plan for MSRTC.

MSRTC’s merger with State Government has been dubbed as ‘not possible’ citing legal, administrative, and financial reasons. It is based on the report of a three-member committee appointed by the Bombay High Court. A look at the financials in the report’s annexures

reveals that the MSRTC has been suffering from losses for years. As per the data incorporated in the

report, MSRTC suffered loss of Rs 121.88 crore in 2015-16. However, that year, the accumulated loss of MSRTC stood at Rs 1,807.22 crore, indicating that the losses started getting accumulated even before 2015-16.

Since 2015-16, MSRTC suffered loss every year. The amount of accumulated loss also kept on mounting. In 2015-16, MSRTC earned revenue of Rs 7,284.48 crore and incurred expenditure of Rs 7,467.23 crore. Thus, it posted loss of Rs 182.75 crore. But, the previous financial adjustments brought down this figure to Rs 121.88 crore. The next year, in 2016-17, the loss was Rs 522.78 crore and the accumulated loss rose to Rs 2,330 crore. It kept on increasing year after year.

As per the audited results for 2019-20, MSRTC’s revenue was Rs 7,870.99 crore and after expenditure and adjustments, the loss was Rs 716.14 crore. That year, the accumulated loss rose further to Rs 5,319.23 crore.

Before the end of 2019-20, COVID-19 pandemic began and troubles increased for MSRTC. As per the unaudited results, MSRTC earned Rs 4,138.10 crore in 2020-21 and incurred expenditure of Rs 5,866.32 crore of which Rs 3,311.36 crore was incurred on employees. The total loss that year was Rs 1,779.94 crore, and the accumulated loss rose to Rs 7,099.17 crore. As per the projections for the current financial year 2021-22, the revenue is expected to increase to Rs 6,890.37 crore, but expenditure also is expected to rise to Rs 10,198.31 crore. The loss this year also is estimated to be Rs 3,307.94 crore, and the accumulated loss is likely to touch a new high of Rs 10,407.11 crore.

However, another annexure with the report tabled in State Legislature on Friday reveals revival plan for MSRTC. The plan is proposed to be implemented for five years starting the next financial year 2022-23.

During this five-year period, MSRTC’s own passenger fleet is proposed to be reduced from 15,380 in 2022-23 to 12,880 in 2026-27. However, the hired fleet size is proposed to be increased from 950 in 2022-23 to 7,000 in 2026-27.

Interestingly, as per the revival plan, the revenue in 2022-23 is expected to be Rs 9,833.88 crore, which is higher than the pre-pandemic level. With steady increase in revenue proposed, revenue in 2026-27 is proposed to be Rs 16,878.07 crore, which is more than double that of 2018-19 level. As far as estimated expenditure in this five year period is concerned, it is projected to be Rs 13,882.25 crore in 2022-23 and Rs 16,843.75 crore in 2026-27. More interestingly, the revival plan actually proposes a trajectory wherein MSRTC will post profit at the end of five-year period. It expects that at least the annual losses will reduce gradually from Rs 4,048.37 crore in 2022-23 to Rs 903.52 crore in 2025-26. And, in 2026-27, MSRTC is expected to post profit of Rs 34.32 crore!

Of course, these projections are based on several ‘assumptions’. These include resumption of normal full-fledged operations, State Government to bear capital cost, high-speed diesel prices at current rate with 3-5 per cent increase every year, CNG prices at current rate with 10 per cent increase every year, marginal rise in fuel cost due to use of alternate fuels, increase in non-traffic revenue due to parcel/retail fuel pumps/tyre retreading etc.

However, some other assumptions may have an impact on MSRTC commuters as well as job aspirants. It is assumed that fare revision shall be carried out every year, and that there will be ‘zero’ recuitment in next five years. Further, the hiring charges are expected to rise by 1-2 per cent every year. For employees, ‘attractive’ voluntary retirement scheme is ‘under consideration’ and proposal for the assistance for the same will be submitted to the Government.