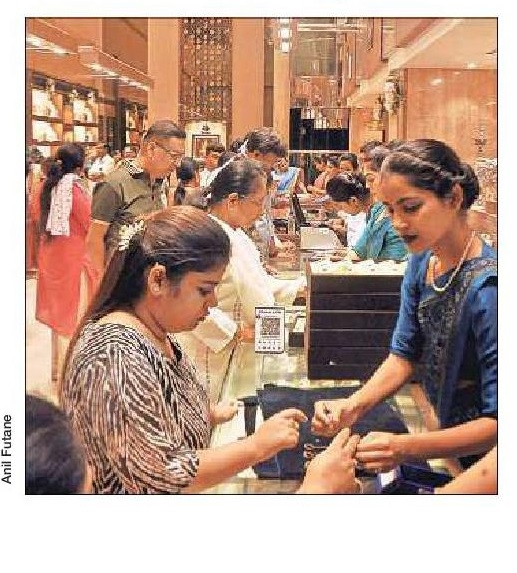

Silver prices shine, touch all-time high of Rs 90,000/kg in city

| Date :23-Sep-2024 |

■ Business Reporter :

■ According to the latest figures released by Ministry of Commerce and Industry, the country’s silver imports in the month of August 2024 jumped more than 7 times to Rs 11,038 cr as compared to Rs 1,317 crore in August 2023

SILVER is shining these days

asitspricehasconqueredanew

high. On September 20, 2024,

silverprices touchedanall time

high of Rs 90,000 per kiloin the

city. The gold and silver prices

arerisingataphenomenalpace

due to high festive and wedding demand across the country.Anothermajorcontributor

to the strong rise in demand is

theloweringof theimportduty

on gold and silver to 6 per cent

from the earlier 15 per cent by

the Government.

“Thesilverprices areexpected to touch Rs 1 lakh per kilo

on the back of strong demand

by Diwali,” said Rajesh Rokde,

Director of Rokde Jewellers,

Secretary of Nagpur Sarafa

AssociationandViceChairman

of All India Gem and Jewellery

Domestic Council (GJC) while

speaking to The Hitavada.

Asa resultofloweringimport

duty, the demand for gold and

silver has accelerated in the

country.

According to the latest figures released by the

Ministry of Commerce and

Industry, the country’s silver

importsin themonthofAugust

2024jumpedmore than7 times

toRs 11,038crore ascompared

toRs1,317croreinAugust2023.

Similarly, country’s gold

importsin themonthofAugust

2024 rose by 103.71 per cent to

Rs 84,401 crore as compared

to Rs 40,883 crore in August

2023.

Kishor Sheth, Director of

Batukbhai and Sons Jewellers

said that silver and gold prices

are creating history due to

strong demand in the international markets. It is seen that

gold and silver prices tend to

risewheninterestratesarelower. Also, the Government

recently slashed the import

duty on gold and silver to 6 per

cent,compared toearlier15per

cent.

“This has had a positive

affect on the demand for gold

and silver to surge,” he said.

Currently, with reduced

import duty the gold and silverpricesare thesameatDubai

andMumbai.Loweringimport

dutyhasincreased thedemand

for the precious metals across

the country.

Lastweek,KishoreShethwas

in Dubai and met a jeweller

who operates 12 showrooms.

In the discussions, Sheth was

informed that the jewellery

demand in Dubai had crashed

by 70 per cent, due to lowering of import duty in India.

People who were going of the

country to buy silver and gold

were now buying in the country itself, as there is no differenceinprices.

Currently, bringing gold and silver in to Indiahas become unviable, headded.

Accordingly, silveris gainingimportanceasitiswidelybeingused in various industriesincluding electronic industryfor manufacturing components.

Also, geopolitical tensionslike war and slowing global

economy are some of the factors that attracts governmentsand people to buy gold.

Other than this, it is estimated that there will be recordnumber of weddings of morethan 35lakh takingplacein thecountry thisyear.Withthis, thegrowthindemand forgoldjewellery is expected to be 25 percent higher, as compared tothe previous year, he said.

(Note: The gold and silverprices are without GST andHallmarking charges).